On December 30, 2020, Law 11/2020, the General State Budget (LPGE), was approved. The LPGE is usually approved every year, however, curiously, we had gone two years without a new Budget Law, as the political community had been unable to agree on new budgets.

With the General State Budget Law they are now approving, they basically aim to increase revenue collection, so we’re faced with either direct tax increases or cuts in deductions or bonuses. One of these cuts is the one related to dividend distributions made within Spain between parent companies and their subsidiaries. Let’s explain:

Until now (31/12/2020), income and dividends from qualified participations, that is, those that met the following requirements, were completely exempt:

- That the parent company’s shareholding in the subsidiary was equal to or greater than 5%, or that the acquisition value of the subsidiary was greater than 20 million euros at the time of the purchase of the shares.

- That the participation in the subsidiary be maintained for at least 12 months uninterruptedly.

- That the subsidiary carries out a real economic activity, that is, it is not considered a holding entity or mere asset manager.

In these cases, the losses from the transfer of these shares or from their market value were not deductible (in accordance with Articles 15.1 and 21.6 of the Corporate Income Tax Law). However, the losses from the dissolution of the investee were deductible, unless it was extinguished as a result of a restructuring operation (Article 21.8 of the same Corporate Income Tax Law).

Well, as of January 1, 2021, we have a new wording in Article 21 of the Corporate Income Tax Law, such that all shareholdings below 5% are no longer considered qualified, even if they cost more than €20 million (although there is a transitional regime for this), and the exemption can only be applied when at least 5% of the shares are held for more than 12 months uninterruptedly. Furthermore, even with this 5%, the exemption will increase from 100% to 95% of income from dividends or capital gains, as management expenses, so these distributions or sales will end up being taxed at an effective rate of 1.25% in the parent company.

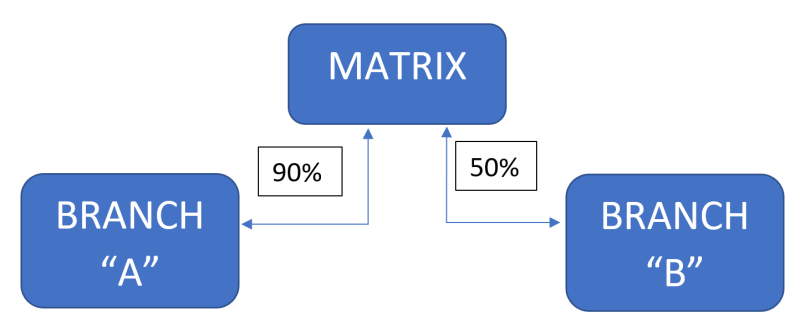

Let’s see it with a drawing and an example:

In our example, the Parent company owns 90% of the shares of Subsidiary “A” and 50% of the shares of Subsidiary “B”, well, in the event of receiving dividends from “A” or selling the shares of “B”, in both cases the exemption can be applied, but if the operations are carried out in 2021 we will have to incorporate 5% of the dividend or capital gain as income in the Parent company so that it is taxed on said percentage.

Let’s suppose that “A” distributes 100 in dividends, of these 100 the Parent Company will receive 90 euros (since it has 90%) and of those 90 euros, 95% will be exempt, so it will have to incorporate 4.5 euros to its taxable income in its corporate tax return, so, if its applicable tax rate is 25%, the Parent Company will end up paying 1.125 euros for this dividend received from Subsidiary “A”, when in 2020 it would not have paid anything.

Similarly, if the Parent Company sells the shares of Subsidiary “B” and receives 100 euros for said sale, it will have to incorporate 5 euros for the same, so at 5% it will effectively pay tax on 1.25 euros, while if it had sold in 2020, it would not have paid any tax on said sale of shares.

So, in summary:

- We need to own at least 5% of the shares.

- 95% of income and capital gains are exempt.

Again, we always recommend consulting experts before carrying out any transaction, including dividend distributions.

Español

Español Русский

Русский