It is becoming increasingly common in the world of small and medium-sized enterprises to hear about holding companies. It is no longer a term reserved for large multinationals, but has become commonplace in the SME business world.

The regulation of this type of company is found in Article 42 of the Commercial Code, according to which:

A group exists when a company holds or may hold, directly or indirectly, the control of one or more other companies.

According to art. 42 Ccom. when:

One of the characteristics of a holding company is that it is a company whose main activity is to hold the shares of other companies; it does not have a specific productive activity. The term comes from the English word “hold” which means “to have”, i.e. it is a company that holds shares in other companies. It is the companies that “hang” from it that carry out the business activity in which each of them is engaged.

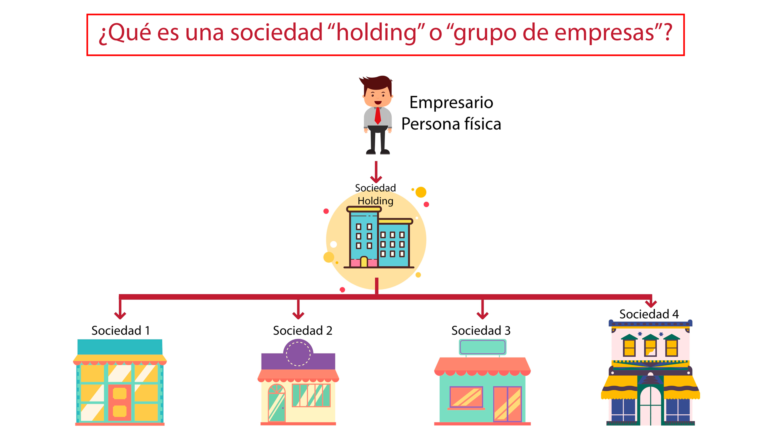

It is therefore a question of creating a company that controls and manages the other companies in the group, which will carry out a specific and independent business activity.

The holding company that manages the group of companies is also known as the parent company, and the basic structure of the group is as follows:

The creation of a holding company has important advantages, both in the organisational development of the company and for tax purposes. Regarding the latter, we recommend reading our previous post which you can consult at the following link: The transfer of shares in a holding company.

For the purposes of organising our own company, the main advantages of setting up a holding company can be summarised as follows:

In short, if we are operating in the legal and mercantile traffic through another type of corporate structure or with a mere company, perhaps it would be the moment to consider the constitution of a Holding or group of companies in order to optimise the management and profitability of our companies and new investments.

Sometimes the Tax Agency carries out inspections because it suspects that some legal figure is…

What is a loan for use Agreement? The Loan for Use is a legal concept…

Do you work on commission? If so, you should know that the legal status of…

On July the 9th, 2021, Law 11/2021, on measures for the prevention and fight against…

“It’s not Common to Reveal Internal Secrets, but the Sector must Continue to Professionalize; We…

On December the 2nd, 2025, the Council of Ministers approved Royal Decree-Law 15/2025, which postpones…