As corporate restructuring transactions, securities exchange transactions are eligible for the special tax regime for mergers, spin-offs, asset transfers, and securities exchanges, which we have discussed in previous articles.

Specifically, Article 76.5 of the Corporate Income Tax Law defines them as:

“An exchange of securities representing share capital shall be considered to be an operation by which one entity acquires a holding in the share capital of another that allows it to obtain the majority of the voting rights in that entity or, if it already has said majority, to acquire a greater stake, by attributing to the partners, in exchange for their securities, other securities representing the share capital of the first entity and, where appropriate, monetary compensation not exceeding 10 percent of the nominal value or, in the absence of a nominal value, a value equivalent to the nominal value of said securities deducted from their accounting records.”

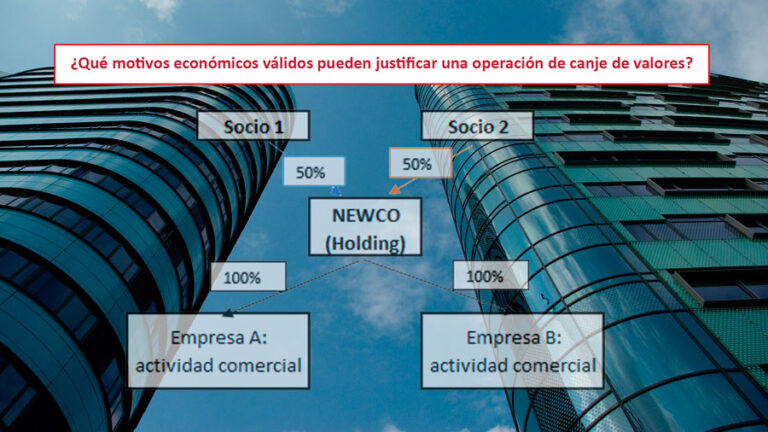

One of the most frequently carried out securities exchange contribution transactions is the creation of a holding company (Newco) and the contribution to it of the shares that individual shareholders hold in other entities.

The simplified operation would be as follows:

That is, in exchange for handing over their shares in Company A and Company B, they receive shares in the NEWCO Holding Company equal to the value of the shares handed over.

So the new graph after the operation would be the following:

This non-monetary contribution of shares, whether the contributing partner is a natural person (as in the example) or a legal entity, would give rise to a “transfer” of shares to the new Holding entity, which, strictly speaking, would determine the creation of a possible capital gain (or loss) that would be taxed.

However, corporate tax regulations establish the possibility of this type of transaction being subject to the special tax regime, thus allowing for the exemption of taxation at the partners’ headquarters for the aforementioned transaction, or, more accurately, allowing for deferred taxation.

However, the possibility of applying this regime always requires that the transaction be carried out for a valid economic reason that justifies it. Or, in other words, that the ultimate purpose of the transaction is not to obtain a tax advantage. In that case, the aforementioned special tax regime would not be eligible.

In recent years, the General Directorate of Taxes has accepted various reasons as economically valid to support the application of the special regime, including:

This aspect is especially relevant when operating subsidiaries generate profits and liquidity for the group. With this structure, funds can be transferred to the parent company via dividend distributions (which could be exempt under Article 21 of the LIS) and invested in new subsidiaries/businesses, either through loans or capital increases, which would also be exempt from taxation.

In short, it would allow a flow of funds between (1) operating subsidiaries with activity and profit (2) parent company and (3) new investment without any tax effects.

As can be seen, there are multiple reasons that may justify the need to create the indicated corporate structure, carrying out a restructuring operation, although it is necessary to note that each operation will always need to be analyzed individually and taking into account the facts preceding and following it, in order to identify the valid economic reasons that concur in each transaction and rule out the tax reason as the sole purpose of carrying out the operation.

For this reason, it is essential to seek proper advice regarding transactions of this type in order to properly document and justify both the transaction to be carried out and the valid economic reasons behind it, thus avoiding tax risks.

Sometimes the Tax Agency carries out inspections because it suspects that some legal figure is…

What is a loan for use Agreement? The Loan for Use is a legal concept…

Do you work on commission? If so, you should know that the legal status of…

On July the 9th, 2021, Law 11/2021, on measures for the prevention and fight against…

“It’s not Common to Reveal Internal Secrets, but the Sector must Continue to Professionalize; We…

On December the 2nd, 2025, the Council of Ministers approved Royal Decree-Law 15/2025, which postpones…