Law 3/2009, of 3rd April 2009, on structural modifications of commercial companies (hereinafter, “LME”) regulates in its Title II the regime applicable to mergers between companies. A fusion is defined as an operation by virtue of which two or more registered commercial companies are integrated into a single company through the transfer as a bloc of their assets and liabilities and […]

mercantile law

It’s a reality now! On 27th September 2013, Law 14/2013, on support for entrepreneurs and their internalisation was presented. Article 18 of said Law indicated that companies’ books must be legalised electronically, with supports on discs and paper being rendered invalid. This refers to the Accounting Books, Minutes and Shareholders’ Books. Despite this, there have […]

There are two main decision-making groups in companies: The General Meeting, which constitutes the governing board and is made up of all the company’s shareholders. The management entity, which exercises the representative functions and is appointed by the company’s General Meeting. It is on this last group that we will focus in this article. The law, in the Royal Legislative Decree […]

If you are thinking on selling shares in your company, below we highlight some of the most important information to bear in mind: Commercially: The transfer of corporate shares is included in our legal system in the Capital Companies Law, Articles 106 et seq. These Articles, among other things, establish the obligation to carry out […]

The office of the non-director secretary is independent and different from that of the corporate directors (or the Board of Directors). This office finds its legal endorsement in Article 529 g of the Capital Companies Law (TRLSC) which, although this precept refers to listed companies, their functions and responsibilities will be the same, regardless of […]

Every day the different Tax Offices[1] are making the application of the regulation more complex, since both want to charge their taxes and they fight among each other to obtain the tax, especially when it is high, as is usually the case with property purchases and sales. At first glance it might seem a trivial […]

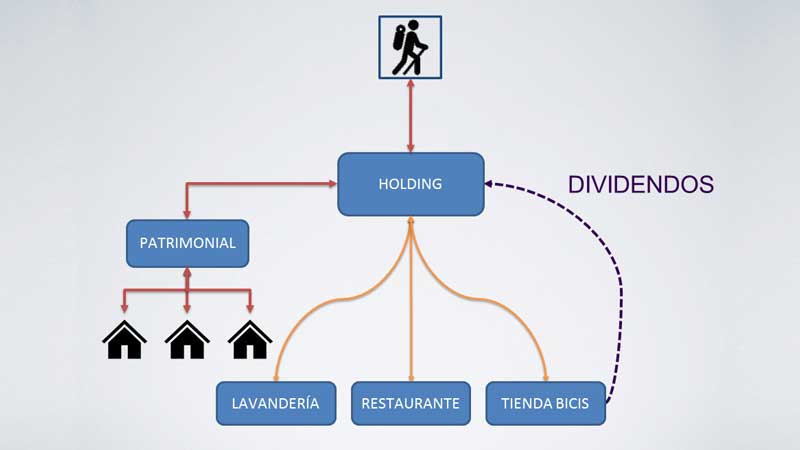

or “The Art of Investing and Not Paying for Profits” In January 2015, Article 21 of the Spanish Corporate Tax Law (hereafter LIS) changed significantly, a modification which is not very well known at this time, but is key to investing in Spain and not paying tax for selling another company’s shares. We are referring […]

We are currently experiencing a boom in the rental of so-called “holiday apartments”, caused by the increase in tourists and the tourist sector in general that Spain is suffering. There are many doubts surrounding the taxation of this type of rental, so, in this post, with the help of our tax lawyers, we’re going to […]

Did you know that you can donate money or assets to a trading company? Have you ever thought that it would be good to strengthen your company’s assets but you weren’t sure how to do it? In this article we explain in which situations and under what circumstances you can make donations to trading companies. […]

Tax consequences of the United Kingdom leaving the European Union without agreement next October 31st, 2019 Next October31st, 2019, the United Kingdom´s exit from the European Union will become effective in the known as “Hard Brexit”, and this State will be considered a “third country” for the purposes of the European Community regulations, unless a […]

Español

Español Русский

Русский