The rules for distributing dividends in capital companies are set out in Royal Legislative Decree 1/2010, of July the 2nd, which approves the Capital Companies Law (hereinafter, LSC). However, these rules appear dispersed throughout the entire legal text, so below we summarize the criteria that must be taken into account by the General Meeting when […]

mercantile law

The presence of a notary public and the public faith that he or she imparts in many of the commercial activities that are carried out on a daily basis means that he or she is even more in demand when conflicts arise or are foreseen, in order to guarantee the impartiality of the acts, also […]

Sometimes, for different reasons, we need to resign from the position of director of a company, but this may not be as easy as it may seem at first sight. We will now set out some indications on the resignation from the position of director. The directors of a limited liability company shall hold office […]

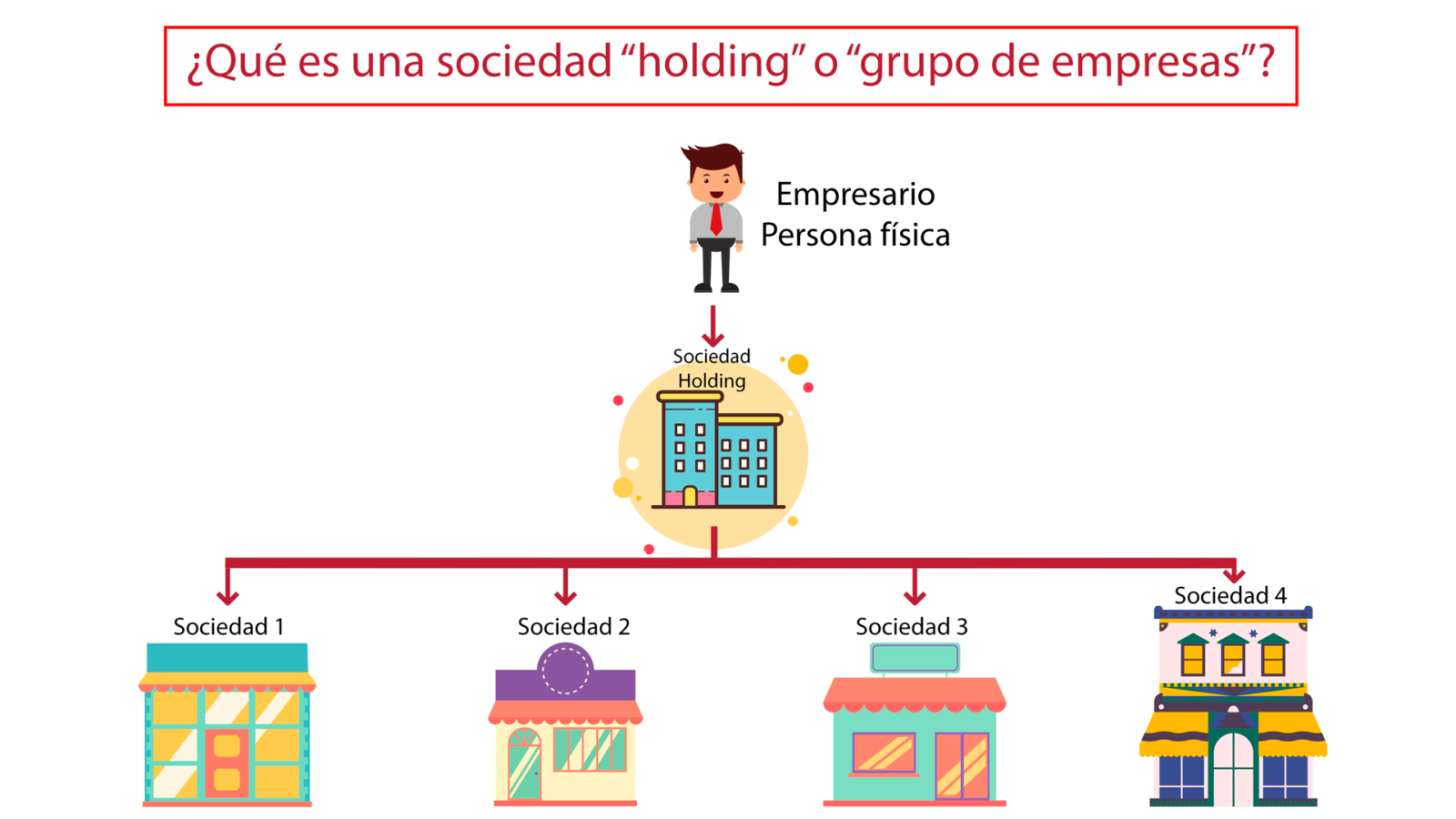

It is becoming increasingly common in the world of small and medium-sized enterprises to hear about holding companies. It is no longer a term reserved for large multinationals, but has become commonplace in the SME business world. But what is a holding company or group of companies? The regulation of this type of company is […]

– Buying a loss-making company – Since 2015, the legislator has restricted the requirements to be able to take advantage of the Losses[1] of one company in another, on the occasion of the purchase of the former, in such a way that in some cases the right to be able to take advantage of said Negative […]

The Tax Group can be used as a tool to reduce taxation, especially when one of our companies generates losses, but there are other reasons why it may be in our interest to form a “Tax Group”. Generally, we will use this special regime with some kind of holding structure, although it is not essential, […]

It is a cause of dissolution of a mercantile company, among others, the one in which due to the losses the Net Worth is reduced to an amount lower than half of the Equity of the company. We would be before the obligation to dissolve the mercantile, and not to do it in the term […]

In a process of acquiring a company, one of the first questions that arises is how to carry out this type of transaction. This operation can be carried out either through the purchase of the shares of the company or through the purchase of the company’s assets. Although both figures may have the same objective, […]

The rules on capital reductions in a company are regulated in the Capital Companies Act (hereinafter LSC), specifically in Articles 317 et seq. and in the Companies Register Regulations. There are various types of capital reduction (reduction due to losses, reduction to provide the legal reserve and reduction to return the value of the contributions), […]

The reason for the corporate reorganisation is debatable if the absorbed company is inactive. Today we bring you a resolution of the Economic Administrative Court of Cataluña, dated 12 February 2018, due to its importance in mergers when a company is absorbed that is not active at the time of the absorption, although it may […]

Español

Español Русский

Русский