We are currently experiencing a boom in the rental of so-called “holiday apartments”, caused by the increase in tourists and the tourist sector in general that Spain is suffering.

There are many doubts surrounding the taxation of this type of rental, so, in this post, with the help of our tax lawyers, we’re going to explain how it works, including subleasing, since more and more companies are appearing to rent out apartments then automatically start subleasing them to tourists.

Before discussing this, we’ll determine one difference: whether they provide hostelry services or not.

Remember that the terms explained below refer to the taxation of rental operations, which has nothing to do with the administrative registration of an apartment, whether it is a holiday apartment or not, because with regards to the Spanish VAT Law, State laws, which regulate these relations, must be adhered to, without taking into account any administrative obligation required by the different autonomous communities, at least, without taking them into account for tax purposes.

Hostelry services refers to cleaning, bedsheet changes, meals, breakfasts, dry cleaning, ironing, towel changes, reception and similar. Moreover, this bears in mind that these services are provided “during” the tenant’s stay and not only before or after. The detail of providing said services during their stay is crucial, since only carrying out these services at the beginning and end of the stay is not considered part of hostelry.

Therefore, with this data we can establish the following possibilities:

This rental can be carried out in two ways:

Here we would be faced with two different activities or actions, two legal relationships:

As can be seen, in the first case (a), the following consequence arises: the management company receives an expenditure invoice including 21% VAT from the apartment’s owner, that is to say 21% VAT applies; and, on the other hand, they receive their income without VAT since they do not provide hostelry services, so, supposing that this is the only income, it would be included in what is known as a “VAT pro-rata” which, for our example, would directly mean that the VAT paid cannot be deducted from their expenses (0% pro-rata). In the event of being unable to deduct any VAT, it is recommended that the VAT is recorded as a major expense of purchases, so that this expense can be used for corporate tax purposes, which is perfectly legal, but in these cases it is not recommended that VAT be refunded. This is a very common error, and the only thing that can be obtained is a sanction from the Spanish Tax Agency for having requested a refund of a tax credit that does not apply.

For the second case (b), in which hostelry services ARE provided, the management company shall receive an invoice for the rental including 21% VAT and shall issue invoices for their services including 10% VAT, in such a way that they can deduct all VAT charged. However, be careful, it could also suffer imbalances in its treasury, since it bears more VAT than it charges, at least percentage-wise, so this growing activity requires a high control of finances, specifically of cash, because, although in this situation it is possible to request the refund of the VAT input, it is important to note that, unless the company is in the Monthly VAT Refund Registry (REDEME) or is a large company, it will have to wait until January to request its corresponding VAT refund. Therefore, the company could face some of the liquidity problems mentioned until it receives said tax refund.

As you can see, this legal relationship is different from the aforementioned relationships and can occur in many cases, since it depends on the agreement that the Management company makes with each apartment owner.

The owner issues the final invoice or receipt to the final user, meaning that it is the owner who has the direct legal relationship with the tourist (tenant), therefore the complaints and claims shall revolve around the owner. Knowing this, there are two options:

In either of the two cases, whether they provide hostelry services or not, a second legal relationship is generated, the one that arises between the intermediary or management company when looking for the tenant, and the owner of the property, since the management company has to charge for its intermediation services. These intermediation services, or real estate commission, generate the obligation for the management company to issue an invoice, being its customer the owner of the property, thus charging the VAT for its services, in this case, at the rate of 21%, since they are real estate intermediation or commission services for having obtained the tenant.

In this last case, the owner may only deduct the VAT charged in the management company’s invoice if they provide hostelry services (charging the tenant 10%), since otherwise (if they do not provide said services) they will not be able to deduct the VAT that they pay when they are in a pro-rata of 0%, as they will not have passed on any VAT to the tenant.

If you have any queries, we recommend that you contact our professionals, lawyers and economists at Ruiz Ballesteros who are experts in tax law.

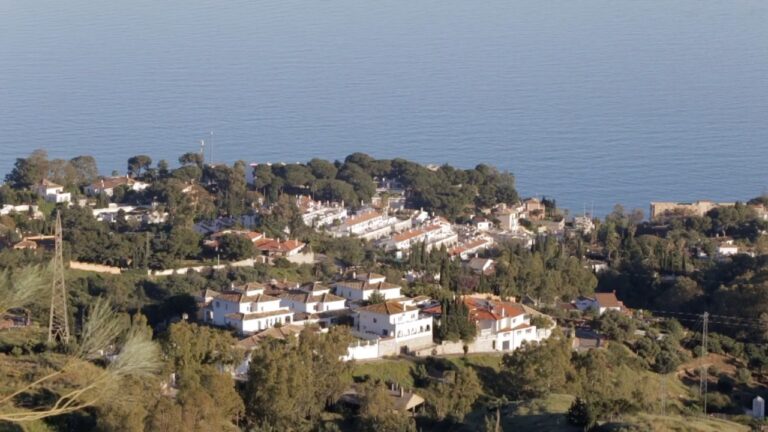

The original conditions of the city of Malaga and its coast (climate, geographical location, gastronomy,…

The rules for distributing dividends in capital companies are set out in Royal Legislative Decree…

The Supreme Court, in a recent ruling (STS 707/2023, of February 28) ruled on whether…

The presence of a notary public and the public faith that he or she imparts…

Individuals who acquire their tax residence in Spain as a result of moving to Spanish…

We obtain a favourable ruling in an eviction trial condemning the tenant to vacate the…

Ver comentarios

As a rental company we provide a platform where the owners can advertise their holiday rentals.

Clients can rent online, make reservation, and pay. The payment arrives to our company, and client gets an invoice (without VAT, as mentioned in your article).

But then the owner gets his part (advertised price-commission) and can withdraw this amount from his account when he desires.

What document the owner will need to give us then? He needs to add 21% VAT (this will need us to rise the advertised price by 21% as well, as we need to pay the 21% and cannot deduct it).

Please clarify.

Dear Christoph,

Thank you for your message in our blogsite.

Regarding your question, it depends the relation that you have with the owner of the house and depending if your are signing/working as agency of the owner (in his name) or like an external agency.

To clarify we would need the contracts/agreements that you have with the owners of the properties, and the agreements that the clients sign. If you want to send us we can give you a budget to clarify everything for your business particulary. conta@jrb.es

Kind regards,