The purpose of this article is to analyze one of the so-called “Special Mergers” regulated in Section 8 of Title II of Law 3/2009, on structural modifications (LME), specifically those regulated in article 49.2 LME, in which the acquiring company absorbs a wholly-owned subsidiary indirectly, in this way the company would absorb a subsidiary of another company of which it holds 100%.

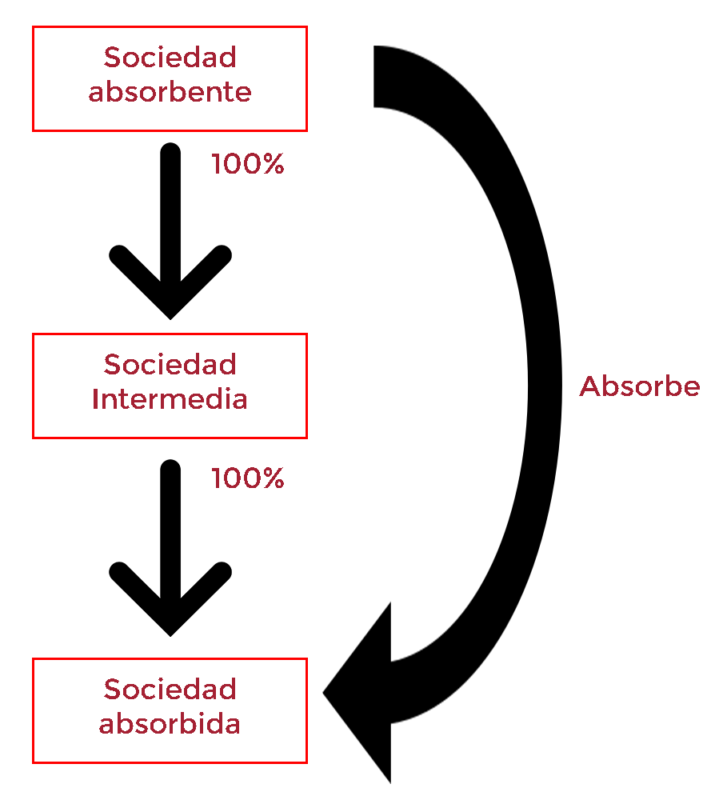

Structure before the merger:

Structure after merger:

This type of merger presents certain special features, which will be analyzed below, with respect to the simplified mergers regulated in article 49.1 LME (https://www.ruizballesteros.es/la-fusion-de-sociedades-ii-fusiones-impropia-directa/).

While some of the advantages of simplified mergers, which were analyzed in the previously referenced article, are applicable to the present case, there are other requirements that appear to be necessary to comply with:

1. Independent expert report

In accordance with the aforementioned article, one of the advantages of the simplified regime is that an independent expert report is unnecessary.

This report, as established in article 34 of the LME, is necessary in those mergers in which one of the participating companies is a public limited company or a limited partnership, and it covers two fundamental aspects:

- The first must explain the methods used by the directors to determine the exchange rate for the shares, interests, or quotas of the partners of the companies being dissolved and explain whether these methods are appropriate.

- The second, on the opinion of whether the assets contributed by the companies being dissolved are equal, at least, to the capital of the new company or to the amount of the increase in the capital of the absorbing company…

However, Article 49.2 of the LME establishes that in this type of merger, the independent expert report referred to in Article 34 of the LME will “always” be required.

A priori, it is surprising that a simplified merger regime has stricter requirements than the general regime itself, since the requirement for an expert report, as we indicated above, only applies to mergers in which one of the participating companies is a public limited company or a limited partnership. However, in view of the wording of Article 49.2, in the case of mergers in which the acquiring company acquires a wholly-owned subsidiary indirectly, an expert report is “always” required, even if the participating companies are not public limited companies or limited partnerships.

Regarding the question of the enforceability of such an expert report when there are no public limited companies or limited partnerships involved in the merger, the doctrine is divided. While most authors consider that it will always be enforceable regardless of the characteristics of the participating companies, another section maintains that it will only be enforceable in those cases in which some of the participating companies are public limited companies or limited partnerships.

Another issue that has generated considerable debate regarding this requirement is the purpose of the appraisal report. As we indicated above, these reports analyze the exchange rate and the equivalence between the assets contributed by the dissolved companies and the amount of the capital increase. Thus, if there is no increase, which may occur as we will see below, there is no alternative content to the information, so it is unclear what the experts will decide when the capital increase does not occur.

Consequently, in view of the above, it appears that there is no unanimous opinion on when this independent expert report is necessary, nor, if so, what it will cover, when, as a result of the merger, a capital increase in the acquiring company is not carried out.

2. Capital increase

Another of the peculiarities of the simplified regime is that it is not necessary to increase the share capital of the absorbing company, since it would involve the assumption or issuance of empty shares or participations, since it would not be assuming a real disbursement in the company, since these are assets that were already included in the balance sheet of the absorbing company.

However, in the case of a merger of companies in which the absorbing company absorbs a wholly-owned subsidiary indirectly, and Article 49.2 LME establishes that, “where applicable,” an increase in the capital of the absorbing company will be required.

A priori, the law leaves open to interpretation the cases in which an increase will be necessary and those in which such an increase in capital is optional.

There are several aspects to analyze on this matter:

- On the one hand, the capital increase in the acquiring company by transferring shares or participations to the intermediate company as compensation for the subsidiary’s capital loss would conflict with the legal prohibition on the original acquisition of shares or participations in the parent company established in Article 134 of the Capital Companies Law, for which there is no exception.

This leads most authors to reject the possibility of capital increases being applicable in cases of takeover of wholly-owned subsidiaries indirectly.

- On the other hand, the capital increase does not reflect a real increase in equity, since the value of the absorbed subsidiary is recorded on the balance sheet of the absorbing parent company, indirectly, since said value is included as a higher equity value of the intermediate company.

All of this leads most legal experts to consider that it is not appropriate to increase capital in any case of absorption of a wholly-owned subsidiary indirectly, especially when the potential damage that the creditors of the intermediate company could suffer would be mitigated by means of the compensation provided for in Article 49 of the LME itself, which we will analyze below.

3. Compensation

Finally, another requirement established by law for this type of merger is that if the merger results in a decrease in the net worth of companies not involved in the merger (intermediary company) due to their stake in the absorbed company, the absorbing company must compensate the latter companies for the fair value of that stake.

The purpose of this rule is to prevent the merger from causing harm to the creditors of the intermediate company, who do not have the right to object, as they do not participate in the merger. However, some authors consider this measure to be excessively protectionist, since it protects the creditors of the intermediate companies more than the creditors of the participating companies, who can only exercise their right to object, which the company can waive if it provides the corresponding guarantees.

However, the main issue raised here is determining the amount of said compensation and the timing of payment. In this regard, legal doctrine has repeatedly stated that the actual receipt of the consideration by the intermediary company should not be a requirement for registration, and its payment cannot be subject to the control of the Commercial Registry. Its determination and payment may even be delayed until after the merger.

In any case, some authors consider that in practice the effectiveness of the compensation to the intermediate company is quite questionable, since it does not in any way prevent the parent company from re-awarding itself the same company at a time after payment of the compensation through a dividend distribution or a capital reduction by means of a return of contributions, since the LME does not establish any mechanism for the unavailability of said compensation.

For all these reasons, we can conclude that the lack of clarity in the law itself, combined with the lack of unanimity among scholars regarding the interpretation of Article 49.2 of the LME, casts doubt on which of the requirements required in this type of merger.

Consequently, our recommendation is that each case be studied in depth, taking into account its specific circumstances, and, where necessary, that the relevant Commercial Registry be consulted.

Español

Español Русский

Русский