This is a little more “special” than our usual articles, because we are going to attempt to explain one of the corporate restructuring operations which is considered “complex”, but which, if executed well, can save us a significant amount of tax and allow us to re-organise our corporate and personal assets.

It must be highlighted that each case should be treated in a unique and special way, without assimilating it to another case that we believe is the same or similar, since the small details normally mark huge differences in any corporate restructuring process.

The best way to discuss this is by giving a real example:

Suppose that “Company A” has 2 shareholders, 50% natural persons and both sole directors, that the company provides financial consultancy services and also owns various properties.

The shareholders, possibly to avoid a present or future crisis, want to separate the properties belonging to the financial consultancy services.

They intend to carry out a corporate restructuring operation so that the transfer of the properties to a new company involves as little taxation as possible, in other words, that they pay the least amount of tax when transferring said properties.

Bear in mind that the norm in a property transfer (sale or exchange) is that the following tax is charged:

In other words, as soon as we transfer one or two properties, taxes can be an absolute impediment to carrying out this corporate operation. For this reason, there is a special regime for mergers, spin-offs, contributions of assets, exchanges of securities and changes in the registered office of a European company to another Member State, which, when properly applied, prevents us from paying these taxes (or several of them), if we do so along with the application of other tax regulations.

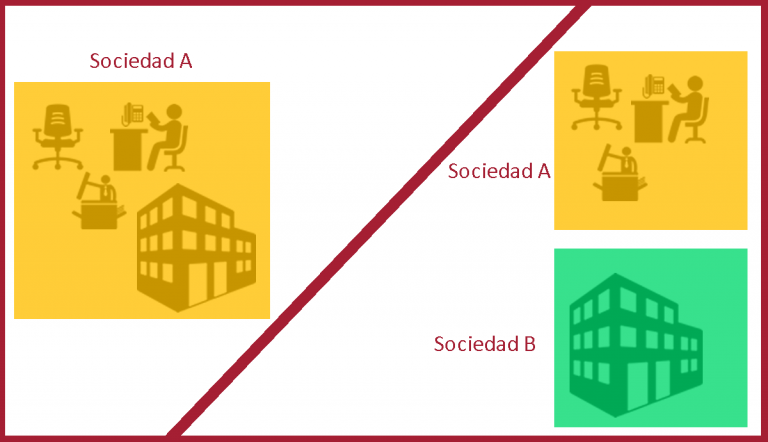

In the example given the shareholders decided to carry out a partial spin-off with a capital reduction and cancellation of shares, transferring all of the company’s properties at their net value to “Company B”, a new company which would receive the properties and would have an identical proportion of shares, that is to say, the two 50% natural-person shareholders.

Following the operation, Company “A” would possess all of the shares involved in financial services activity, including furniture, computers, software and staff specialised in the field, as well as maintaining the customers. On the other hand, Company “B”, the new company created, would then carry out property rental activities with part of the property spun off, counting on a full-time staff member to do so.

Corporate Tax (or LIS using its Spanish abbreviation) considers partial spin-off to be the operation through which: “”an entity segregates one or more parts of its shareholders’ equity that form branches of activity and block transfers them to one or more newly created or existing entities, keeping in its shareholders’ equity at least one branch of activity in the transferring entity, or shares in the capital of other entities that give it the majority of their share capital, receiving in exchange securities representing the share capital of the acquiring entity, which must be attributed to its shareholders in proportion to their respective shares, reducing the share capital and reserves by the necessary amount, and, where appropriate, a cash payment”.

In turn, Spanish Law 3/2009, of 3rd April, on structural modifications of trading companies, establishes the concept and requirements of spin-off operations in the commercial field. Specifically, “partial spin-off is understood to be the block transfer by universal succession of one or various parts of a company’s equity, each of which forms an economic unit, to one or more new or existing companies. The shareholders of the company being spun off receive a number of shares, stakes or shares in the companies benefiting from the spin-off in proportion to their respective shareholdings in said company, and the latter reduces the share capital by the necessary amount”.

Moreover, “branch of activity will be understood as the group of assets and liabilities which are capable of constituting an autonomous economic unit determining an economic exploitation, i.e. a group capable of functioning on its own. The debts incurred for the organisation or operation of the items transferred may be attributed to the acquiring entity.”

Therefore, from many replies to queries, the Spanish General Tax Directorate understands that the requirements to be fulfilled in order to be able to apply the special regime in partial spin-off operations would be:

In this specific example, the company had properties which were country estates, garages, industrial warehouses and apartments, but no clear differentiated economic activity was determined, at least according to how the company explained its situation and organisation, since it did not appear to have the material and human resources necessary to carry on the rental activity. Therefore, in principle, it could not apply the special regime for Corporate Tax. Thus, if the company had carried out this operation, it would have been taxed on the profits obtained from the property transfers, since it did not meet the requirements set forth therein.

Since the special tax regime does not apply, we must refer to Article 17 of the LIS which states that the assets transferred by virtue of a total or partial spin-off must be valued at “market value” and the difference between the market value and the tax value must be included in the taxable income.

The original conditions of the city of Malaga and its coast (climate, geographical location, gastronomy,…

The rules for distributing dividends in capital companies are set out in Royal Legislative Decree…

The Supreme Court, in a recent ruling (STS 707/2023, of February 28) ruled on whether…

The presence of a notary public and the public faith that he or she imparts…

Individuals who acquire their tax residence in Spain as a result of moving to Spanish…

We obtain a favourable ruling in an eviction trial condemning the tenant to vacate the…