The Tax Group can be used as a tool to reduce taxation, especially when one of our companies generates losses, but there are other reasons why it may be in our interest to form a “Tax Group”.

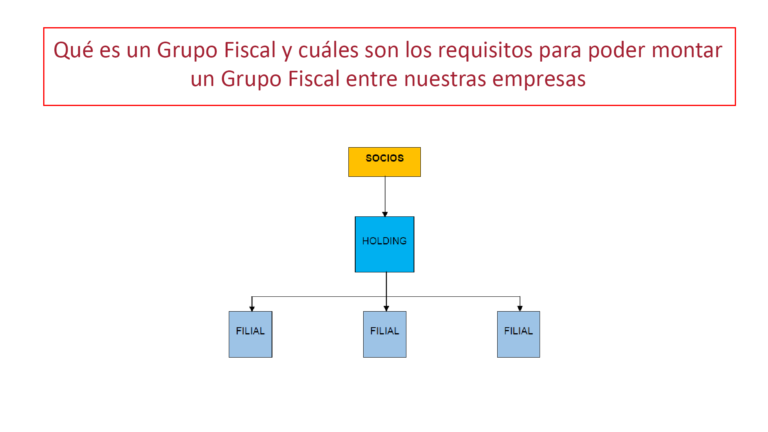

Generally, we will use this special regime with some kind of holding structure, although it is not essential, since, as we will see, a minimum percentage of ownership of one company in another is required. Let us begin by defining the Tax Group.

In this respect, the tax group is the application of the special regime of the same name, which is applied on a voluntary basis and is defined as such in the Corporate Income Tax Law and its Regulations.

The tax consolidation regime is configured as the result of the algebraic sum of the individual tax bases of the entities resident in Spain, adjusted by the eliminations and additions corresponding to intra-group transactions, i.e. the sum of the tax bases of all the companies in the tax group will be corrected by certain transactions that have been carried out between the companies that make up the tax group.

A typical tax group would be formed by the following companies:

In order for two or more companies to form a tax group, the following conditions must be met:

The tax group operates as a single entity, so any requirements or qualifications will be determined by the configuration of the tax group as a single entity. This means that each member company of the group will file a corporate tax return which ends when it reaches the taxable income box, and the parent/representative company will be responsible for grouping all the taxable income and completing the consolidated return, so that only this entity will apply adjustments and incentives, such as capitalisation and equalisation reserves, to its tax.

Therefore, the consolidated statements will refer to the same closing date and period as the annual accounts of the entity representing the tax group, and the rest of the entities forming part of the tax group must close their financial year on the date on which the entity representing the tax group closes its financial year.

The entities that make up the tax group are subject to the tax obligations deriving from the individual taxation system, except for the payment of the tax debt, which is concentrated in the representative entity.

The representative entity will file the tax return using form 220 and in electronic format, tax consolidation regime, the deadline being that which coincides with its tax period, i.e. 25 calendar days following the six months after the end of its tax period.

The entity representing the tax group must draw up, for tax purposes:

The following information shall be attached to the above documents:

The original conditions of the city of Malaga and its coast (climate, geographical location, gastronomy,…

The rules for distributing dividends in capital companies are set out in Royal Legislative Decree…

The Supreme Court, in a recent ruling (STS 707/2023, of February 28) ruled on whether…

The presence of a notary public and the public faith that he or she imparts…

Individuals who acquire their tax residence in Spain as a result of moving to Spanish…

We obtain a favourable ruling in an eviction trial condemning the tenant to vacate the…