In January 2015, Article 21 of the Spanish Corporate Tax Law (hereafter LIS) changed significantly, a modification which is not very well known at this time, but is key to investing in Spain and not paying tax for selling another company’s shares.

We are referring to taxation when a company sells shares to another company and obtains a profit from doing so. These are large (and small) operations that save money, and which in a well-organised business structure make the difference to be able to continue investing profits in new companies.

Spanish companies’ taxable income is made up of the amount of income (revenue) obtained in the tax period, which in many cases coincides with the calendar year, i.e. from 1st January to 31st December, and can be reduced by the tax losses of previous years.

This taxable income is determined using direct estimation, that is, revenue minus expenses are calculated to make the profit. Once possible deductions are applied, the tax rate is applied.

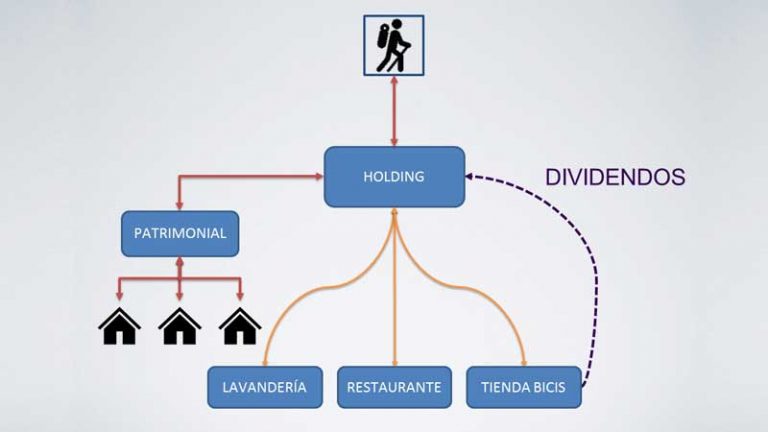

We define a holding company as a company whose sole or main corporate purpose and asset is the holding of shares in third companies, that is, the holding of shares in subsidiary companies or companies in which we invest in order to leave one day and reinvest in others.

A holding company will be considered as such if, in addition to this corporate purpose and asset, it is considered to carry out an economic activity; otherwise, it will be a parent company. Fortunately, the corporate tax reform introduced by Law 27/2014 incorporated an express statement of the concept of “economic activity”, which now allows us to distinguish between a company with activity and one without it.

This reform clarified that companies in which more than half of their assets are constituted by securities are excluded from being considered as a company with “activity”. It also clarifies that the following shares are not considered as securities for the purpose of considering the company as a parent company or not:

As you can see, all of the requirements must be fulfilled as a whole, not just some of them.

If all of said requirements are fulfilled, the holding company could benefit from the advantages discussed below:

One of the most common possibilities of obtaining income in a Holding Company is receiving dividends from the companies in which they invest. Once these “producing” companies have paid their corporate tax at a rate of 25%, they can distribute dividends to their parent company and partners, so the interesting thing about Article 21 of the LIS is that it legalises an obvious difference between being a partner as a natural person and being a partner as a legal person:

Not only do they avoid taxation, but the obligation to make a withholding at the time of distribution is directly avoided, which does occur, as we have said, if the dividends are distributed to natural persons.

Therefore, our holding company is completely exempt from taxation.

This system allows money to go back and forth flexibly from the holding company to the generating company or other subsidiaries to finance projects without any cost.

As with the distribution of dividends, the same thing happens with the sale of shares when the seller is our holding company.

Moreover, the requirements for this exemption are the same, except one small difference:

…

Moreover, another requirement must be added:

In accordance with the current regulation, the sale of shares is fully exempt, provided that they have a percentage share of more than 5% (or an acquisition value of more than 20 million euros) and are held for more than one year.

The substantial improvement made to the law is that the exemption for the sale of shares is absolute; that is, it includes not only the reserves generated by the performance of the company’s economic activity even before its acquisition by the shareholder transferring it, but also any unrealised capital gains that may exist (these capital gains have been exempt from taxation since 1st January 2015). The only requirement for applying this full exemption is that the transferred company is not considered as a parent company pursuant to the Corporate Tax Law. In other words, that it is not a company in which more than half of its assets are composed of values (quoted shares, bonds, investment funds and other investments), or of other assets not related to an economic activity.

Application of the exemption is independent from the percentage transferred and the percentage remaining after the transfer operation, as well as of the acquisition value of the share which, in this case, has not been transferred.

As you can imagine, these operations must only be carried out under the supervision of an expert and recognised firm to avoid misunderstandings or flawed interpretations, since the Tax Office pays great attention to these operations. Among other things, companies cannot be constituted with the sole purpose of making the sale and applying this exemption, i.e. there must be a true economic activity and the company must not have created the proper elements purely to avoid taxation.

The original conditions of the city of Malaga and its coast (climate, geographical location, gastronomy,…

The rules for distributing dividends in capital companies are set out in Royal Legislative Decree…

The Supreme Court, in a recent ruling (STS 707/2023, of February 28) ruled on whether…

The presence of a notary public and the public faith that he or she imparts…

Individuals who acquire their tax residence in Spain as a result of moving to Spanish…

We obtain a favourable ruling in an eviction trial condemning the tenant to vacate the…