It is common that various people are joint owners of one or various assets and, very often, one of these is a property. This is usually due to the fact that the asset has been acquired by various individuals at the same time, that it belongs to a community of property or comes from an […]

Yearly Archives: 2020

The true taxation of the costs of judicial procedures is difficult to answer. We must first focus on the question and the concept of costs, since they are considered a credit to the prevailing party. However, this credit is different from the credit that comes from a service leasing contract between the lawyer and the […]

Many companies and natural persons are unaware of the existence of the so-called ETE form (Statement of Foreign Transactions) and the obligation to present it if a certain number of transactions with non-residents is exceeded or if they have assets in foreign countries. The Statement of foreign economic transactions and asset and financial liability balances […]

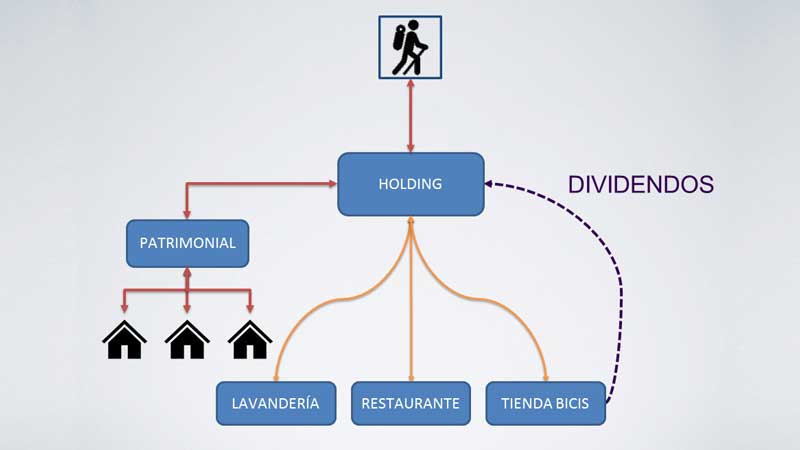

Exemption from Corporate Taxation This is a little more “special” than our usual articles, because we are going to attempt to explain one of the corporate restructuring operations which is considered “complex”, but which, if executed well, can save us a significant amount of tax and allow us to re-organise our corporate and personal assets. […]

In a company, the decision to finance the purchase of a property with a financial product or other is not insignificant. In the majority of cases a mortgage is used, however, there are other finance products that deserve to be studied, particularly property leasing, in order to make an educated decision on how to acquire […]

or “The Art of Investing and Not Paying for Profits” In January 2015, Article 21 of the Spanish Corporate Tax Law (hereafter LIS) changed significantly, a modification which is not very well known at this time, but is key to investing in Spain and not paying tax for selling another company’s shares. We are referring […]

We are currently experiencing a boom in the rental of so-called “holiday apartments”, caused by the increase in tourists and the tourist sector in general that Spain is suffering. There are many doubts surrounding the taxation of this type of rental, so, in this post, with the help of our tax lawyers, we’re going to […]

Did you know that you can donate money or assets to a trading company? Have you ever thought that it would be good to strengthen your company’s assets but you weren’t sure how to do it? In this article we explain in which situations and under what circumstances you can make donations to trading companies. […]

1. PURPOSE OF THE DOCUMENT We issue a new extraordinary note to inform all our clients firsthand about the measures that the Government of Spain has taken to palliate the coronavirus crisis, published on 18 March 2020. These measures attend to business, labor, tax and personal aspects of all Spanish people. Support measures for the […]

Is it necessary to carry out a procedure to regularize their situation in Spain? On January 31, 2020, the United Kingdom left the European Union and, with it, endless questions about the consequences that this will entail, not only for residents of the European Union in the United Kingdom, but also for those British who […]

- 1

- 2

Español

Español Русский

Русский