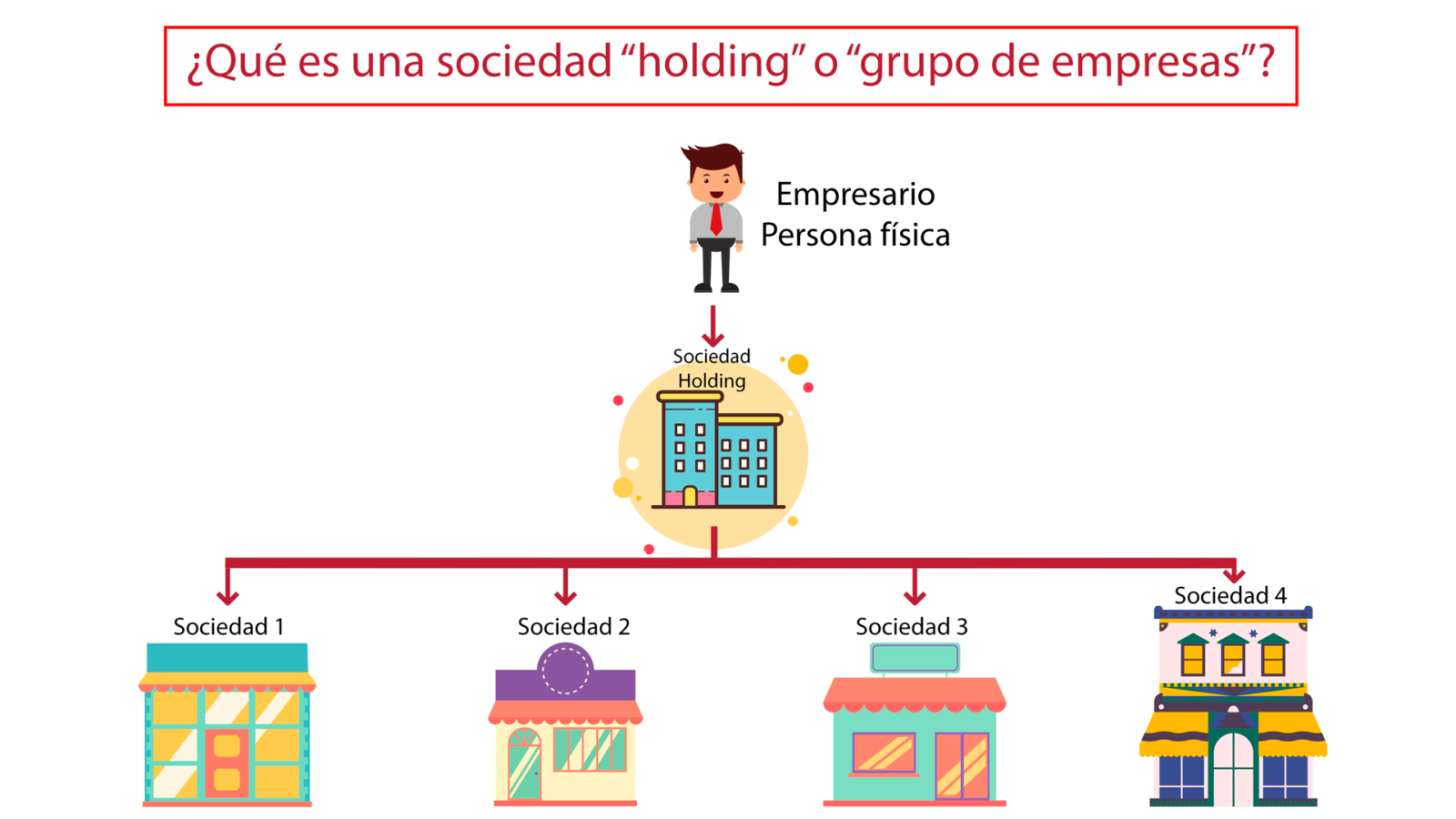

It is becoming increasingly common in the world of small and medium-sized enterprises to hear about holding companies. It is no longer a term reserved for large multinationals, but has become commonplace in the SME business world. But what is a holding company or group of companies? The regulation of this type of company is […]

Author Archives: Ruiz Ballesteros Abogados y Asesores Fiscales

Did you know that you can receive part of the R+D+I deduction that you cannot apply in your corporate income tax return in money? As we published in our post titled “What Does the Research and Development Deduction Consist of?”, the application of this deduction is probably the most profitable in terms of the amount […]

It is common that various people are joint owners of one or various assets and, very often, one of these is a property. This is usually due to the fact that the asset has been acquired by various individuals at the same time, that it belongs to a community of property or comes from an […]

Many companies and natural persons are unaware of the existence of the so-called ETE form (Statement of Foreign Transactions) and the obligation to present it if a certain number of transactions with non-residents is exceeded or if they have assets in foreign countries. The Statement of foreign economic transactions and asset and financial liability balances […]

Tax consequences of the United Kingdom leaving the European Union without agreement next October 31st, 2019 Next October31st, 2019, the United Kingdom´s exit from the European Union will become effective in the known as “Hard Brexit”, and this State will be considered a “third country” for the purposes of the European Community regulations, unless a […]

A few months ago, we already explained in a post the tax changes that had been approved in Andalucía, under the Decree-Law 1/2019, of 9th April, which modifies the refunded text of the dictated provisions by the Andalusian Autonomous Community in matters of ceded taxes, approved by the Legislative Decree 1/2018 of 19th June. This modification […]

Español

Español Русский

Русский