Sometimes the Tax Agency carries out inspections because it suspects that some legal figure is being used with the sole intention of reducing taxation, in which case it usually resorts to article 16 of Law 58/2003, of December 17, General Tax Law (hereinafter, LGT), to justify the “simulation” of a legal transaction and apply a […]

Blog

What is a loan for use Agreement? The Loan for Use is a legal concept defined in the Spanish Civil Code, specifically in article 1740, which states that:Under a Loan Agreement, one party delivers to the other either a non-fungible item for use for a certain period, after which it must be returned—in which case […]

Do you work on commission? If so, you should know that the legal status of a commission agent is often confused with that of a sales agent, as they share some similarities. We’ll explain the main differences between these two concepts, according to current legislation, so you can determine which contract is best for you. […]

On July the 9th, 2021, Law 11/2021, on measures for the prevention and fight against Tax Fraud, was published. This law has brought about significant Tax changes. In this article, we will focus on one of them, which corrects the surcharges applied when Tax Returns are filed late. Specifically we are referring to section 2 […]

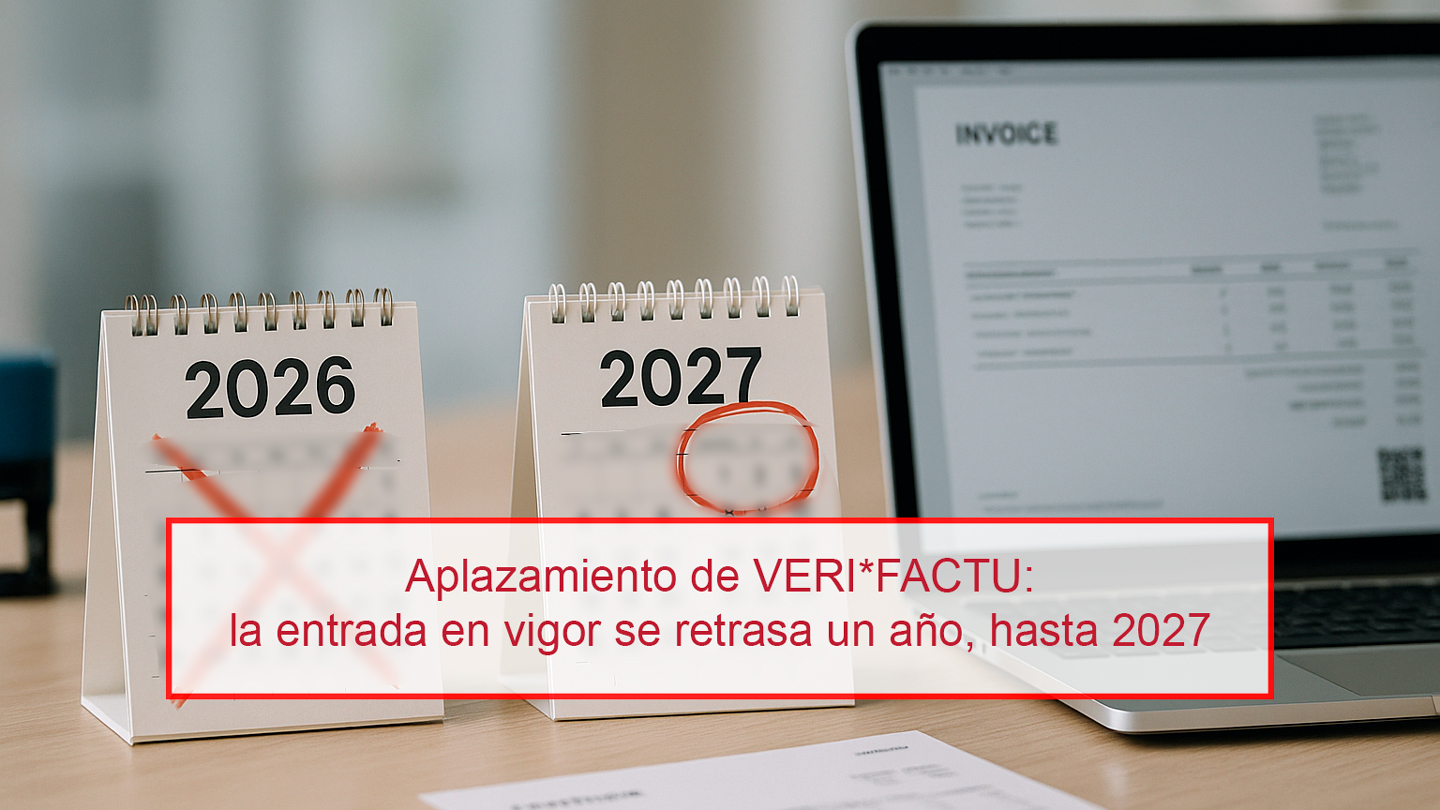

On December the 2nd, 2025, the Council of Ministers approved Royal Decree-Law 15/2025, which postpones for one year the entry into force of the Obligations derived from the so-called VERI*FACTU Regulation (Verifiable Invoice Issuance System) and the requirements of the Computer Billing Systems regulated in Royal Decree 1007/2023. This Royal Decree-Law must be validated by […]

The valuation of shares or participations company’s valuation is a requirement for tax purposes due to various circumstances that may arise in the lives of citizens and businesses. Correctly determining the value from a tax perspective depends on the circumstances that require the valuation, such as the sale of shares, a donation, an inheritance, a […]

The historical background of the trust dates back to Roman and Germanic law, although it is a typical figure of English law (“Common Law”), originating from the medieval division of property belonging to the Crown, which granted rights of enjoyment and use to feudal lords. The nobles, in turn, had trustees (“feofee”) who administered their […]

Personal income tax is a direct, personal tax levied on the income of individuals, based on their personal and family circumstances. There are several exempt incomes, detailed primarily in Article 7 of Law 35/2006, of November 28, on Personal Income Tax (hereinafter, IRPF). We will specifically refer to those included in section “p” of the […]

As corporate restructuring transactions, securities exchange transactions are eligible for the special tax regime for mergers, spin-offs, asset transfers, and securities exchanges, which we have discussed in previous articles. Specifically, Article 76.5 of the Corporate Income Tax Law defines them as: “An exchange of securities representing share capital shall be considered to be an operation […]

This article is a continuation of the article “The merger of companies. General aspects” and aims to analyze one of the so-called “Special Mergers” regulated in Section 8 of Title II of Law 3/2009 on structural modifications (LME). This type of merger is characterized by the fact that the law provides for the possibility of […]

Español

Español Русский

Русский