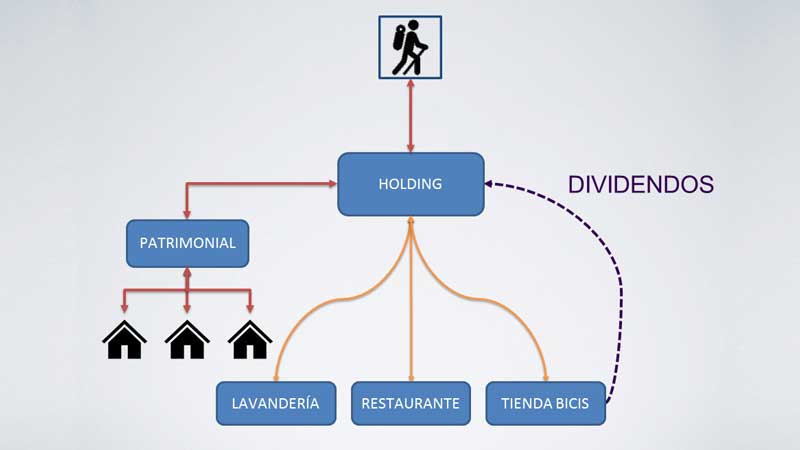

Exemption from Corporate Taxation This is a little more “special” than our usual articles, because we are going to attempt to explain one of the corporate restructuring operations which is considered “complex”, but which, if executed well, can save us a significant amount of tax and allow us to re-organise our corporate and personal assets. […]

Author Archives: Jesús R. Ballesteros

or “The Art of Investing and Not Paying for Profits” In January 2015, Article 21 of the Spanish Corporate Tax Law (hereafter LIS) changed significantly, a modification which is not very well known at this time, but is key to investing in Spain and not paying tax for selling another company’s shares. We are referring […]

We are currently experiencing a boom in the rental of so-called “holiday apartments”, caused by the increase in tourists and the tourist sector in general that Spain is suffering. There are many doubts surrounding the taxation of this type of rental, so, in this post, with the help of our tax lawyers, we’re going to […]

1. PURPOSE OF THE DOCUMENT We issue a new extraordinary note to inform all our clients firsthand about the measures that the Government of Spain has taken to palliate the coronavirus crisis, published on 18 March 2020. These measures attend to business, labor, tax and personal aspects of all Spanish people. Support measures for the […]

New developments in taxation for 2017 As from 1st January 2017 it is illegal to pay more than 1,000 euros in cash. On 2nd December 2016 the Spanish Cabinet passed a Decree-Law which reduces the amount of cash payments to 1,000 euros (up until now the limit was 2,500€), as payment for any goods or […]

People considered Non-Resident for Tax Purposes in Spain have two ways of obtaining some kind of revenue (income): either through a permanent establishment or without any permanent establishment being involved. In the first case, with a permanent establishment[1], tax is paid on the entire revenue attributable to that establishment, regardless of the place where the […]

Continuing on from our previous article, let´s assume that we are a company, that first we bought a plot of development land and on this land we have built ten apartments, we have paid VAT on the purchase of the land and also during the construction of the apartments, as we have contracted the services […]

If you have read our previous post “When do we apply VAT to a purchase of urbanised land“, you will know that we are buying a plot of land that is urbanised or in the process of being urbanised, for which we will be paying VAT at 21 %. Assuming for example that the price […]

Spanish tax residency rules Clients often tell us “I’m not Tax Resident in any country”. It is a serious mistake to think one is not a tax resident, because when you least expect it, the Spanish Tax Agency, or that of any another country can claim taxes from you as a resident, and bearing in […]

When buying urbanised land, a very clear distinction must be made between the two important taxes that can be applied, of which one excludes the other. It is important to know that it is possible to apply VAT on the purchase of a plot of land, as the VAT paid on the purchase can be […]

Español

Español Русский

Русский