The rules for distributing dividends in capital companies are set out in Royal Legislative Decree 1/2010, of July the 2nd, which approves the Capital Companies Law (hereinafter, LSC). However, these rules appear dispersed throughout the entire legal text, so below we summarize the criteria that must be taken into account by the General Meeting when […]

Blog

The Supreme Court, in a recent ruling (STS 707/2023, of February 28) ruled on whether the contributions made to the Banking Labor Mutuality (hereinafter, MLB) in the period between January the 1st 1967 and December the 31st, 1978, the Second Transitional Provision (hereinafter, DT2ª) of Law 35/2006, of November the 28th, on the Personal Income […]

The presence of a notary public and the public faith that he or she imparts in many of the commercial activities that are carried out on a daily basis means that he or she is even more in demand when conflicts arise or are foreseen, in order to guarantee the impartiality of the acts, also […]

Individuals who acquire their tax residence in Spain as a result of moving to Spanish territory may opt to pay Non-Resident Income Tax, in compliance with the special rules established for this purpose in Article 93(2) of Law 35/2006 of 28 November on Personal Income Tax. This regime allows non-resident workers posted to Spanish territory […]

We obtain a favourable ruling in an eviction trial condemning the tenant to vacate the property and pay the rent due, but what happens if the tenant files an appeal against this ruling? In eviction proceedings for non-payment of rent or expiry of the contract term, we often find that, despite having obtained a favourable […]

Many property purchasers when buying high value properties wonder whether it would be a good idea to set up a company to own the property and save tax. Is this the case or is it counterproductive to have the house in the name of a company? In order to be able to answer these questions […]

Sometimes, for different reasons, we need to resign from the position of director of a company, but this may not be as easy as it may seem at first sight. We will now set out some indications on the resignation from the position of director. The directors of a limited liability company shall hold office […]

What is the Golden Visa? It is a residence visa for investors, created by Law 14/2013 on support for entrepreneurs and their internationalisation, destined for citizens from outside the European Union who wish to come to Spain to reside. Who can apply for the Golden Visa? All those who make a minimum investment of 500,000 […]

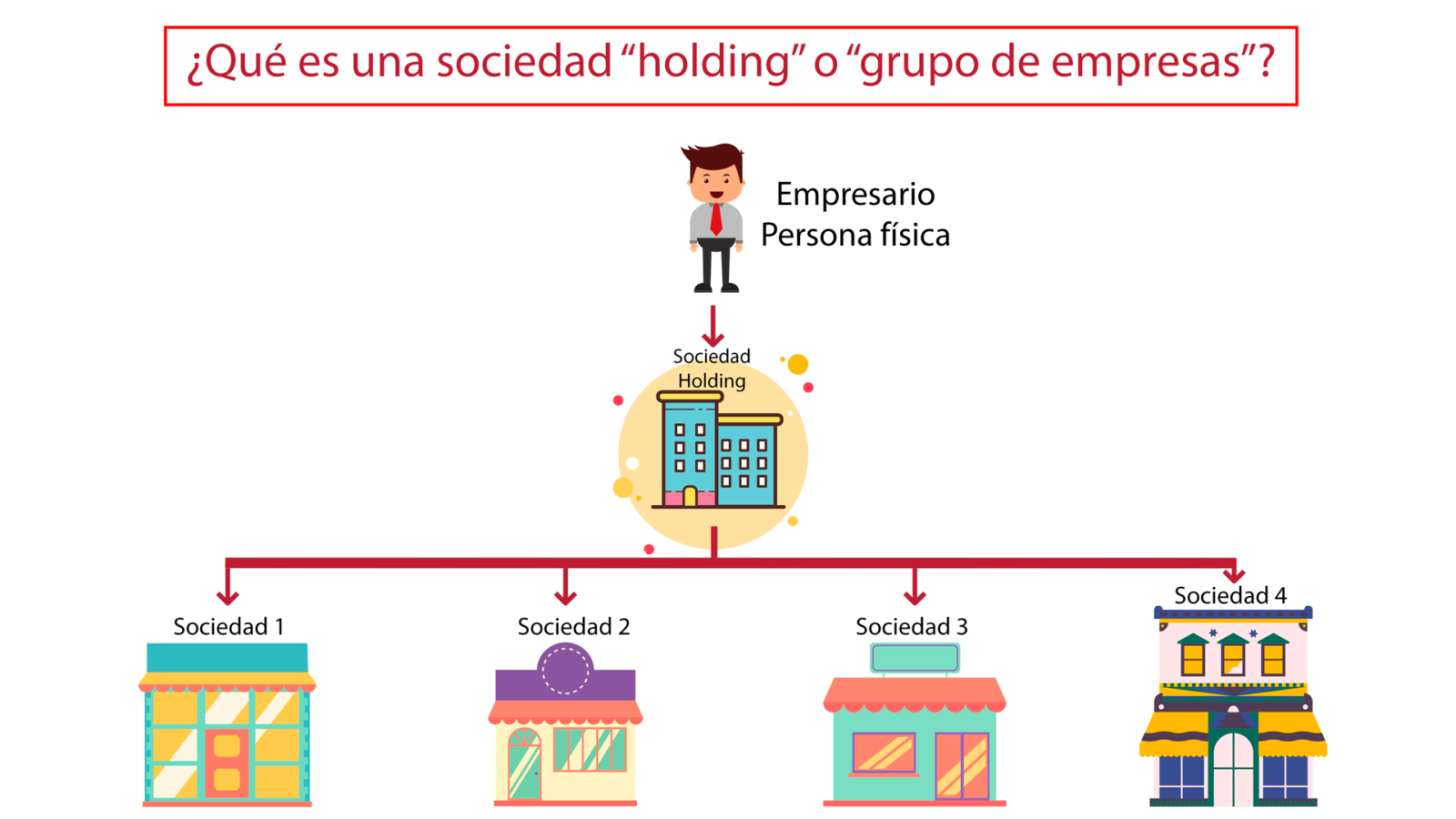

It is becoming increasingly common in the world of small and medium-sized enterprises to hear about holding companies. It is no longer a term reserved for large multinationals, but has become commonplace in the SME business world. But what is a holding company or group of companies? The regulation of this type of company is […]

– Buying a loss-making company – Since 2015, the legislator has restricted the requirements to be able to take advantage of the Losses[1] of one company in another, on the occasion of the purchase of the former, in such a way that in some cases the right to be able to take advantage of said Negative […]

Español

Español Русский

Русский