Law 3/2009, of 3rd April 2009, on structural modifications of commercial companies (hereinafter, “LME”) regulates in its Title II the regime applicable to mergers between companies.

A fusion is defined as an operation by virtue of which two or more registered commercial companies are integrated into a single company through the transfer as a bloc of their assets and liabilities and the attribution to the partners of the companies being extinguished of shares or participations in the resulting company, which may be a newly created company or one of the merging companies.

What are the reasons that may lead to a merger?

The reasons for carrying out a merger can be varied, however, the majority of them respond to an economic decision, such as the improvement of joint efficiency, the creation of synergies, the possibility of accessing new markets, risk diversification, etc.

In any case, the objectives must be clear and well defined in order to successfully complete the merger process.

Types of mergers

From the definition of merger itself, we can draw the conclusion that there are different types of mergers.

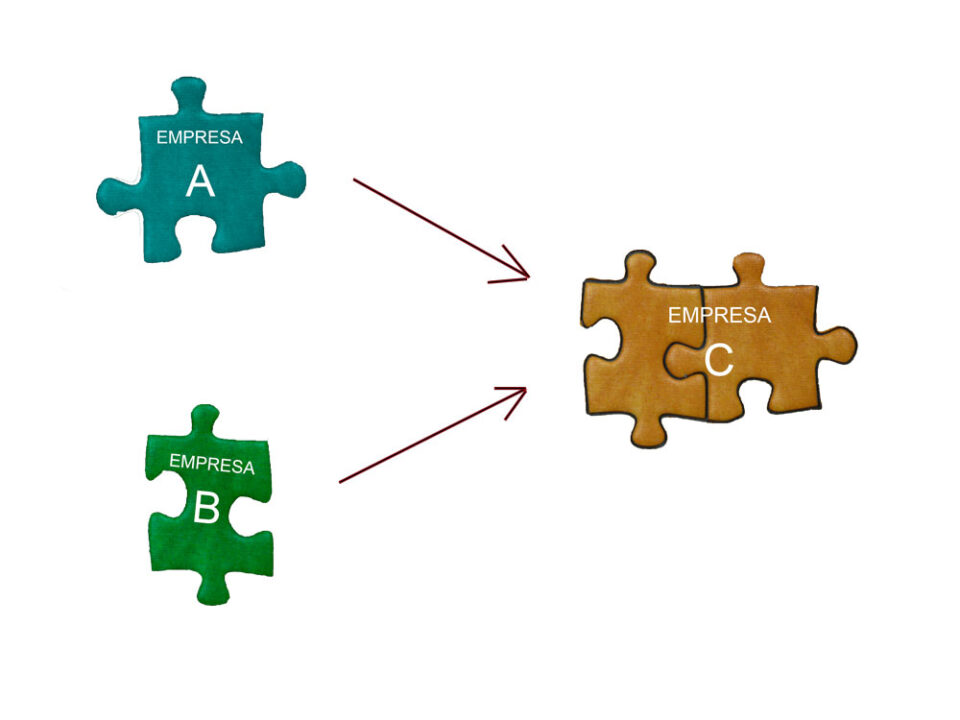

Pure merger:

It would be the merger of the merged companies into a new company, which are extinguished by the transfer of their assets and liabilities to the newly created company.

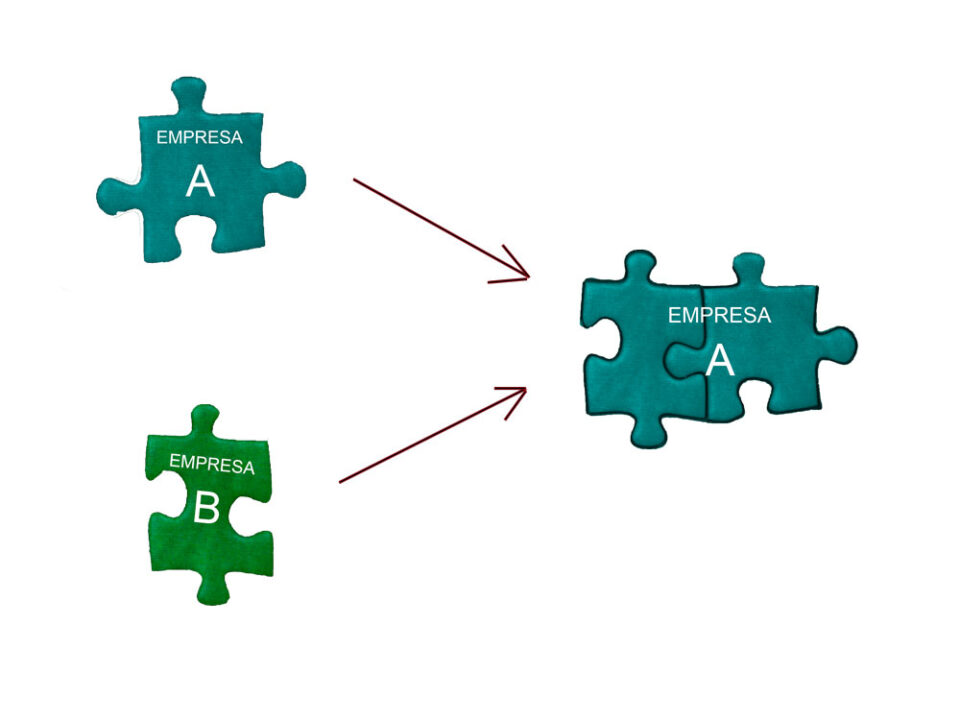

Absorption merger:

Merger by virtue of which one of the companies acquires by universal succession the assets of the absorbed companies, increasing, the capital stock of the absorbed company by the appropriate amount.

Effects

Therefore, in view of the above, we can conclude that there are three main effects that occur in a merger:

- Transfer as a bloc of the assets and liabilities of the companies involved in the merger to the absorbing or newly created company. In other words, the companies will transfer all their assets and liabilities to the absorbing company or, in the case of a pure merger, to the new company.

- Delivery to the partners of the extinct companies of shares or participations of the newly created company or absorbing company. This exchange will be made on the basis of the real value of the assets contributed.

- Dissolution, without liquidation, of the companies that have transferred their assets and liabilities.

Phases

Having analyzed the types of mergers, as well as their main effects, it should be pointed out that this type of operation is of certain complexity, not only from a business decision point of view, but also in its execution. Therefore, in order to provide greater clarity, the following is a brief description of the different phases involved in this type of transaction.

Preparatory phase:

This phase includes the following steps:

- Preparation of the merger project:

The administrative board of each of the companies involved in the merger will draw up the merger plan, which establishes the merger’s bases and whose minimum content is set forth in Article 31 LME (i.e. exchange procedure, bylaws of the resulting company, etc.).

Prior to the approval of the merger by the general meeting, the merger plan must be published on the website of the companies participating in the merger, unless any of them does not have a website, in which case it must be deposited in the Commercial Registry.

It is also important to take into consideration that the shareholders’ meeting of the companies participating in the merger must approve the merger within 6 months from the date of the merger plan. Otherwise, the merger plan will be null and void.

- Report of the administrative board

The administrators of each of the companies participating in the merger will prepare a report explaining and detailing the main economic and legal aspects of the merger project, mainly regarding the exchange of shares, as well as the implications of the merger for shareholders, creditors and employees.

- Independent expert´s report

This report will only be required when any of the companies participating in the merger is a corporation or a limited partnership by share.

Decision making phase:

This phase consists of the following steps:

- Making available the merger information and documentation:

Prior to the publication of the notice, a series of documents must be made available to the shareholders, bondholders, holders of special rights and the representatives of the employees, including: the merger plan, the annual accounts for the last 3 fiscal years, the merger balance sheet of each of the companies, etc. (article 39 LME).

It is important to take into consideration, with respect to the merger balance sheet, that any balance sheet closed within the 6 months prior to the merger plan may be considered as a merger balance sheet.

In the event that the annual balance sheet does not meet this requirement, it will be necessary to prepare a balance sheet closed after the first day of the third month preceding the date of the merger plan.

- Convocation of general meeting

General convocation of each of the companies, at least one month prior to the meeting.

- Resolution of the general meeting

The merger must be approved by each of the General Meetings of the companies involved.

- Publication agreement

The merger agreement must be published in one of the newspapers of wide circulation in which each of the companies has its address and in the Official Gazette of the Mercantile Registry.

- Creditor´s right of objection

Creditors may oppose the merger within a period of one month from the publication of the merger resolution until their credits have been secured, provided that such credits arose prior to the date of publication of the merger plan on the website or its deposit with the Commercial Registry.

Execution phase:

The merger will culminate with:

- The granting of the merger deed

Once the period for opposition by creditors has elapsed, the merger agreement must be made public.

- Registration in the commercial register

The merger will not take effect until the deed of merger is registered in the Commercial Registry.

Once the resulting company has been registered, the entries of the extinct companies will be cancelled.

Special mergers

In accordance with the above, the merger process is a complex process; however, the law provides for the so-called “special mergers” in which some of the requirements are simplified. Although such mergers will be the subject of study in later articles, we can distinguish the following among the special mergers:

- Improper merger:

Is a type of merger by absorption in which the absorbing company owns 100% of the shares or participations of the absorbed company.

- Reverse merger:

The absorbed company owns, directly or indirectly, 100% of the absorbing company.

- Merger by absorption of a 90% owned company.

- Merger between partners.

In this case the absorbing company and the absorbed company have the same partners, who participate in equal proportion in each of the companies.

- Merger in which the operation is approved unanimously by the partners.

Provided that the companies do not have the status of public limited company.

- Merger of a leveraged company.

The tax regime applicable to this type of operation, which can be very beneficial for the companies involved, will also be analyzed in subsequent articles.

Español

Español Русский

Русский