What happens to the VAT if the tenant of my premises doesn’t pay me? Should I stop issuing invoices? When the tenant stops paying the rent of a premises, the owners usually make various mistakes, such as: The first mistake that is usually made is to stop issuing invoices. It’s true that this generates […]

The concept and peculiarities of gifts in Spanish law are set out in the Spanish Civil Code, specifically in Articles 618 et seq. Said Articles indicate that it is a free act by which a person who owns an asset disposes of it and gives it away free of charge in favour of another person […]

Every day the different Tax Offices[1] are making the application of the regulation more complex, since both want to charge their taxes and they fight among each other to obtain the tax, especially when it is high, as is usually the case with property purchases and sales. At first glance it might seem a trivial […]

Today we are discussing a very special case that we are sure you’ll find interesting. Suppose that we establish a company to construct one single house, and while we are building it a buyer appears who wants to take over the company, that is to say, they will be directly acquiring the company shares and […]

It is common that various people are joint owners of one or various assets and, very often, one of these is a property. This is usually due to the fact that the asset has been acquired by various individuals at the same time, that it belongs to a community of property or comes from an […]

The true taxation of the costs of judicial procedures is difficult to answer. We must first focus on the question and the concept of costs, since they are considered a credit to the prevailing party. However, this credit is different from the credit that comes from a service leasing contract between the lawyer and the […]

Many companies and natural persons are unaware of the existence of the so-called ETE form (Statement of Foreign Transactions) and the obligation to present it if a certain number of transactions with non-residents is exceeded or if they have assets in foreign countries. The Statement of foreign economic transactions and asset and financial liability balances […]

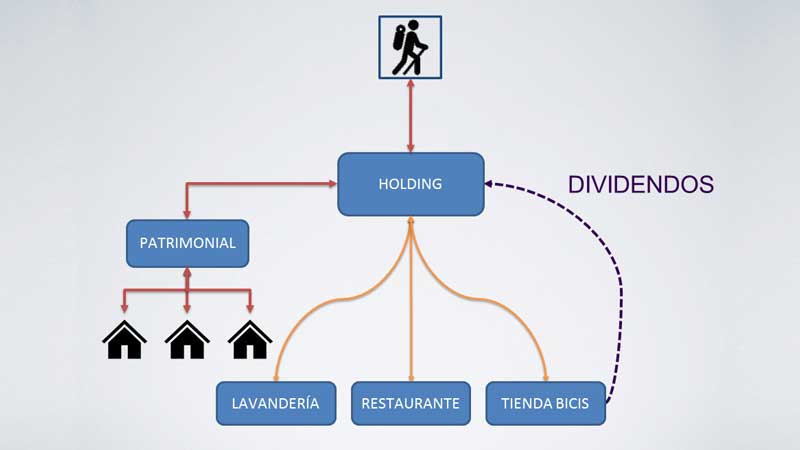

Exemption from Corporate Taxation This is a little more “special” than our usual articles, because we are going to attempt to explain one of the corporate restructuring operations which is considered “complex”, but which, if executed well, can save us a significant amount of tax and allow us to re-organise our corporate and personal assets. […]

In a company, the decision to finance the purchase of a property with a financial product or other is not insignificant. In the majority of cases a mortgage is used, however, there are other finance products that deserve to be studied, particularly property leasing, in order to make an educated decision on how to acquire […]

or “The Art of Investing and Not Paying for Profits” In January 2015, Article 21 of the Spanish Corporate Tax Law (hereafter LIS) changed significantly, a modification which is not very well known at this time, but is key to investing in Spain and not paying tax for selling another company’s shares. We are referring […]

Español

Español Русский

Русский