In a company, the decision to finance the purchase of a property with a financial product or other is not insignificant. In the majority of cases a mortgage is used, however, there are other finance products that deserve to be studied, particularly property leasing, in order to make an educated decision on how to acquire […]

Tax law

or “The Art of Investing and Not Paying for Profits” In January 2015, Article 21 of the Spanish Corporate Tax Law (hereafter LIS) changed significantly, a modification which is not very well known at this time, but is key to investing in Spain and not paying tax for selling another company’s shares. We are referring […]

We are currently experiencing a boom in the rental of so-called “holiday apartments”, caused by the increase in tourists and the tourist sector in general that Spain is suffering. There are many doubts surrounding the taxation of this type of rental, so, in this post, with the help of our tax lawyers, we’re going to […]

Did you know that you can donate money or assets to a trading company? Have you ever thought that it would be good to strengthen your company’s assets but you weren’t sure how to do it? In this article we explain in which situations and under what circumstances you can make donations to trading companies. […]

Tax consequences of the United Kingdom leaving the European Union without agreement next October 31st, 2019 [toc] Next October31st, 2019, the United Kingdom´s exit from the European Union will become effective in the known as “Hard Brexit”, and this State will be considered a “third country” for the purposes of the European Community regulations, unless […]

A few months ago, we already explained in a post the tax changes that had been approved in Andalucía, under the Decree-Law 1/2019, of 9th April, which modifies the refunded text of the dictated provisions by the Andalusian Autonomous Community in matters of ceded taxes, approved by the Legislative Decree 1/2018 of 19th June. This modification […]

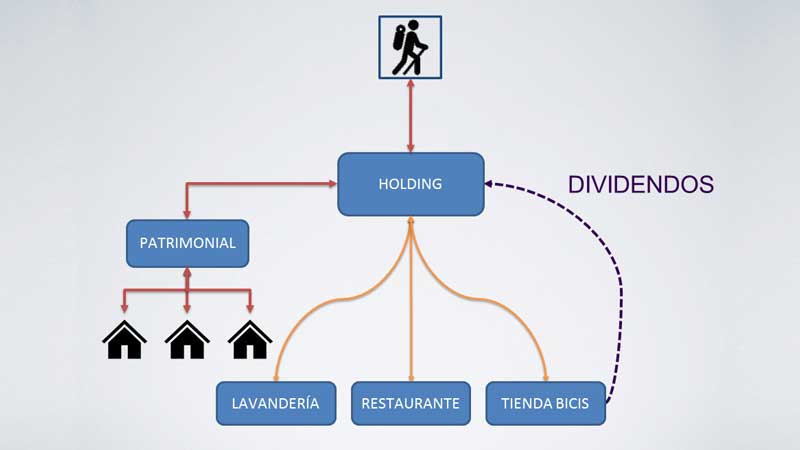

Operations with Related Shareholders and Valued at Market Price [toc] · Holding Company: Article 5 of the Corporate Income Tax Law defines a holding company as a company in which more than half of its assets are composed of securities or of other assets not related to an economic activity. Moreover, the Law clarifies that, […]

Since the creation of this “Plusvalía Municipal” tax, there is an obligation to tax the profits obtained on the sale of real estate, it is paid whether a profit or not has been made on the sale of the property. However, on last Thursday May 11th, 2017, it was agreed to declare this law unconstitutional […]

New developments in taxation for 2017 As from 1st January 2017 it is illegal to pay more than 1,000 euros in cash. On 2nd December 2016 the Spanish Cabinet passed a Decree-Law which reduces the amount of cash payments to 1,000 euros (up until now the limit was 2,500€), as payment for any goods or […]

People considered Non-Resident for Tax Purposes in Spain have two ways of obtaining some kind of revenue (income): either through a permanent establishment or without any permanent establishment being involved. In the first case, with a permanent establishment[1], tax is paid on the entire revenue attributable to that establishment, regardless of the place where the […]

Español

Español Русский

Русский